Le crowdfunding : comment ça marche ?

Le financement participatif : définitionHistoire du financement participatifLes différentes étapes d'une campagneLes plus-values pour un porteur de projetCrowdfunding, crowdlending, crowdequity : quelles différences ?Comment choisir sa plateforme ?Cagnotte et financement participatif : quelle différence ?La finance participative : les chiffres clés 2022

Un bref retour sur l’histoire…

Comment se passe une campagne de crowdfunding ?

Financement participatif : quelles plus-values ?

Crowdfunding, crowdlending, crowdequity : quelles différences ?

Le crowdfunding : le don avec ou sans contrepartie

▶︎ Pour quels types de projets ?

▶︎ Le don participatif en quelques chiffres

▶︎ Quelle réglementation pour les plateformes de don ?

▶︎ L’info en plus

Le crowdlending : le prêt participatif

▶︎ Pour quels types de projets ?

▶︎ Le prêt participatif en quelques chiffres

▶︎ Quelle réglementation pour les plateformes de prêt ?

▶︎ L’info en plus

Le crowdequity : l’investissement en capital

▶︎ Pour quels types de projets ?

▶︎ L’investissement participatif en quelques chiffres

▶︎ Quelle réglementation pour les plateformes d'investissement en capital ?

Comment choisir sa plateforme ?

Des plateformes généralistes et spécialisées

- un secteur d'activité : agriculture, musique, cinéma, énergies renouvelables...

- une communauté : catholique, musulmane...

- un type d'entités/acteurs : entreprises, associations, projets personnels de particuliers (mariage, études, achat d'une voiture...), collectivités territoriales...

Les plateformes généralistes : quelles avantages ?

À chaque plateforme ses particularités

Cagnotte et crowdfunding : quelle différence ?

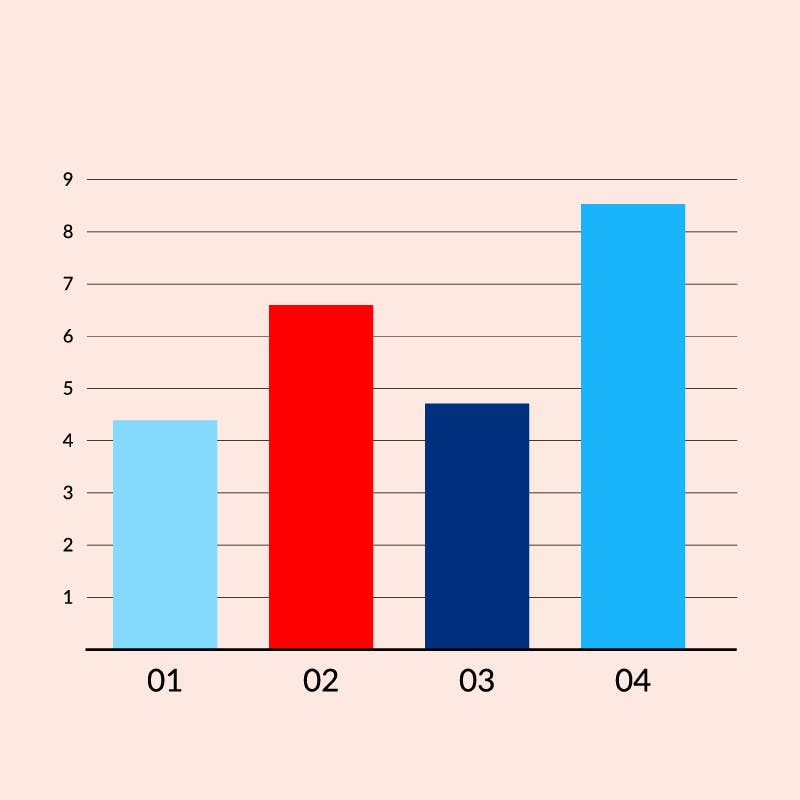

La finance participative en France : les chiffres clés 2022